Many people plan a skiing trip during the winter holidays. Their plans include skiing not only in the Polish Tatra Mountains, but also abroad, in Slovakia, the Czech Republic, Austria, Italy, Switzerland or France. However, before we set out to another country, it is worth securing oneself should medical assistance become necessary.

How not to lose a fortune when travelling for a holiday?

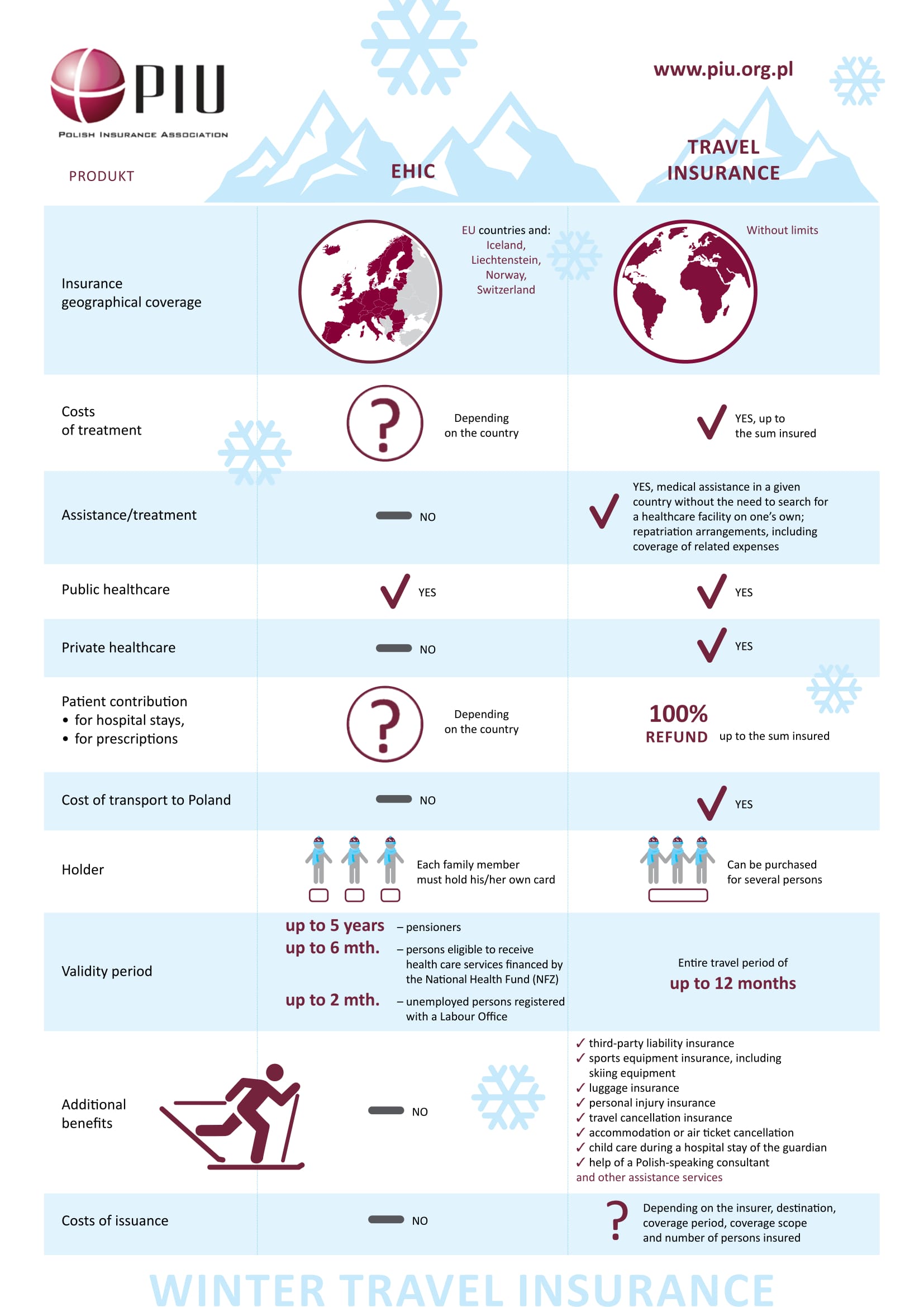

Although very useful, the European Health Insurance Card (EHIC) does not ensure full and free medical care, mountain rescue abroad and medical transport to Poland. Unfortunately, the costs of such interventions may reach several hundred and even tens of thousands euro. Therefore, to protect your home budget, it is worth securing tourist insurance that will cover the potential costs related to an unforeseen event and decrease waiting time for appropriate benefits. In many European countries we must be ready to co-finance medical services. Therefore, it is advisable to find out in advance how medical care in the country we are travelling to is organised. Additional insurance will allow us to fully enjoy the holiday.

The basics: EHIC

Each person travelling abroad should carry an EHIC, confirming eligibility for medical services outside of Poland. More importantly, each member of the family must have their own document and a number of copies thereof, as it is often required to be left at the medical establishment.

In the Czech Republic you have to pay for services1

At our southern neighbours’ an EHIC holder will benefit from free consultation of primary care doctors. Where a visit to a hospital emergency department is involved, the EHIC holder has to pay a one-off fee of 90 crowns. The costs of treatment at an establishment operating outside the public healthcare system are to be fully paid by the patient. Where the patient sought emergency medical assistance at private establishments, he/she may claim partial reimbursement of the costs involved.

Note! An EHIC holder is not eligible for medical treatment provided by the mountain rescue service in connection with a skiing accident. The patient is obliged to cover full costs of such aid on his/her own.

Payable mountain rescue in Slovakia2

In Slovakia primary care and outpatient specialist care services are free of charge. In the case of a visit to the emergency service, a one-off fee of EUR 1.99 is charged; however, it is cancelled when the patient requires hospitalization. Ambulance transport, including air ambulance, is free of charge, but the same benefits provided by the mountain rescue must be fully paid for by the injured.

Payable stay at a hospital in Austria3

In Austria, in the case of hospital treatment not longer than 28 days the patient has to pay from EUR 12 to EUR 20.1 per day. The basic standard hospital stay includes accommodation and medical service. Employees of the hospital may present the patient with the option of hospitalisation with improved care standard, but in such case he/she has to take additional costs into account. Transport to the hospital is free of charge in the event of threat to life or when the doctor considers that the patient’s condition so requires. Important – mountain rescue and air transport are non-reimbursable!

Free hospital treatment in Italy4

In Italy, the costs of primary care medical advice have to be paid for by the patient – up to EUR 36.15 for a visit. Consultant services will be partially financed by the National Health Fund (NFZ). Interestingly, hospital treatment in Italy is free of charge, however the EHIC holder will have to contribute to the transport. It is worth knowing that in many resorts there are only private doctors’ establishments, which do not recognise the EHIC. Moreover, health benefits associated with the consequences of sport accidents may be subject to higher charges than standard healthcare services.

In Switzerland you have to pay for a GP visit5

The EHIC holder has to pay 33 francs in the case of minors and 92 francs for adults for advice of a general practitioner, a consultant, a dentist or stationary hospital treatment. Furthermore, the cost of hospitalisation is 15 francs per day. Children and persons up to 25 years of age who continue to learn are exempt from the fee. Pregnant women using health care services are exempt from these charges. However, every patient using medical road or aircraft transport, including in the event of mountain rescue, is obliged to cover 50% of the costs.

In France the surcharge for a GP visit is 30%6

A patient enjoying healthcare benefits on the basis of the EHIC in France has to first cover the costs by him/herself and may apply for their partial reimbursement. The cost of primary care physician’s and dentist’s consultation amounts to EUR 23, whereas of consultant’s consultation – EUR 25. To recover the costs, a set of relevant documents has to be filed with the French health care fund. In such case 70% of the costs shall be reimbursed upon return to the country. What is important, if the doctor we are visiting is charging a fee higher than the rates set in the health care fund’s price list, the patient has to pay the difference by him/herself. In the case of hospital treatment, the health care fund covers 80% of treatment costs; 100% in some cases only. The patient must cover the remaining 20%, including the daily lump-sum fee. Mountain rescue cost is 100% paid by the injured.

How to select a tourist policy tailored to your needs?

Let us remember to think carefully what protection we need and who should it cover before purchasing policies. One policy may protect one or several persons, for example the entire family. In addition to medical care, a tourist policy usually covers the costs of destroyed or lost luggage, abandonment of accommodation already paid for or damage to electronic or sports equipment. Where we become responsible for an accident, for instance on the ski slope, civil liability insurance covers the costs of victim treatment or repair of his/her equipment.

Usually, tourist insurance enables us to select two options concerning the sports practised: amateur or competitive, and each insurer defines these categories differently. The General Terms and Conditions of Insurance often specify individual disciplines. Before signing an agreement, we have to read the document and decide which option is appropriate for us. If there are any questions as to the scope of protection, we should request the insurer to provide explanations, for instance through the hotline. A tourist policy may be purchased in many ways. Contact with an insurance agent remains the most popular one. Insurance may also be contracted over the internet or via a hotline. The cost of a tourist policy for the entire family for a two-week trip should not exceed several hundred PLN.

[1] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/czechy

[2] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/slowacja

[3] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/austria

[4] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/wlochy

[5] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/szwajcaria

[6] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/francja