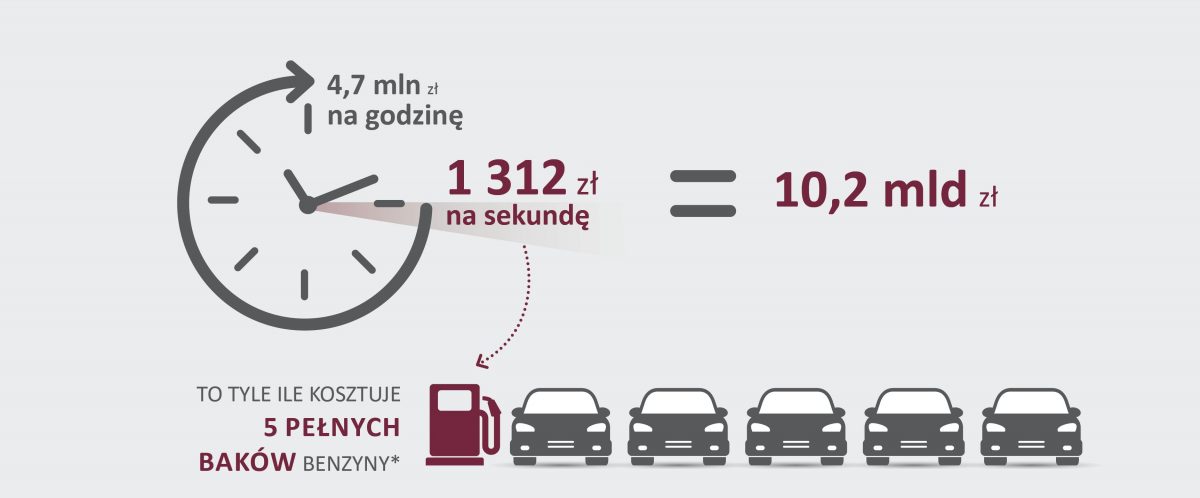

In Q1 2019, Poles received PLN 10.2 billion in insurance compensation and benefits. Each hour of an insurer’s work amounted to PLN 5 million in aid for the injured. In Poland, damage covered by RCA is repaired once every thirty seconds.

Key insurance market figures after Q1 2019

- PLN 10.2 billion for the injured, including:

- PLN 5.1 billion for life insurance

- PLN 3.7 billion for motor insurance

- PLN 1.4 billion for other insurance

- Insurers invested PLN 74.6 billion in assets in domestic bonds and other fixed-income securities supporting the economy and public finance

- PLN 16.8 billion in assets invested in shares of WSE companies and other variable-income securities

- PLN 343 million of income tax will be paid by insurers to the State budget

‘In the first quarter of this year alone, insurers compensated more than 300,000 damages covered by RCA. The injured received more than PLN 2.3 billion in compensation and benefits, which is more than 2.5% more than the previous year’, said J. Grzegorz Prądzyński, president of the Board of the Polish Chamber of Insurance.

Insurers ready for sudden weather phenomena

In Q1 2019, Poles spent almost PLN 6 billion on the protection of their vehicles, of which approx. PLN 3.7 billion constituted RCA contributions and approx. PLN 2.2 billion were comprehensive cover contributions. At the same time, we bought insurance against the effects of natural forces for more than PLN 1 billion. ‘The results for Q1 do not cover the costs of the flooding and windstorms which occurred in May this year. However, it is known that insurance companies are prepared for all weather conditions, both in organisational and financial terms. The simplest damages are already liquidated within one day and insurers commonly use simplified liquidation procedures’, explained Andrzej Maciążek, vice-president of the Board of PIU.

State budget support

Poles spent more than PLN 5.2 billion in Q1 2019 on life insurance, which is 7.7% less than

in the same period last year. They received almost PLN 5.1 billion in benefits as a result.

‘Popularisation of individual protection of life and health is one of the biggest challenges in the insurance market. We live longer and our standard of living is increasingly higher; we often have credit liabilities for several decades. Proper life insurance should be the standard in terms of protecting our closest family’, stressed J. Grzegorz Prądzyński.

In Q1 2019, Polish insurers produced more than PLN 1.1 billion of net profit — 8.6% more than in the previous year. This means PLN 343 million of income tax for the State budget. In addition, insurance companies also paid approx. PLN 120–130 million of so-called asset tax.