Many people plan a skiing trip during the winter holidays. Their plans include skiing not only in the Polish Tatra Mountains, but also abroad, in Slovakia, the Czech Republic, Austria, Italy, Switzerland or France. However, before we set out to another country, it is worth securing oneself should medical assistance become necessary.

How not to lose a fortune when travelling for a holiday?

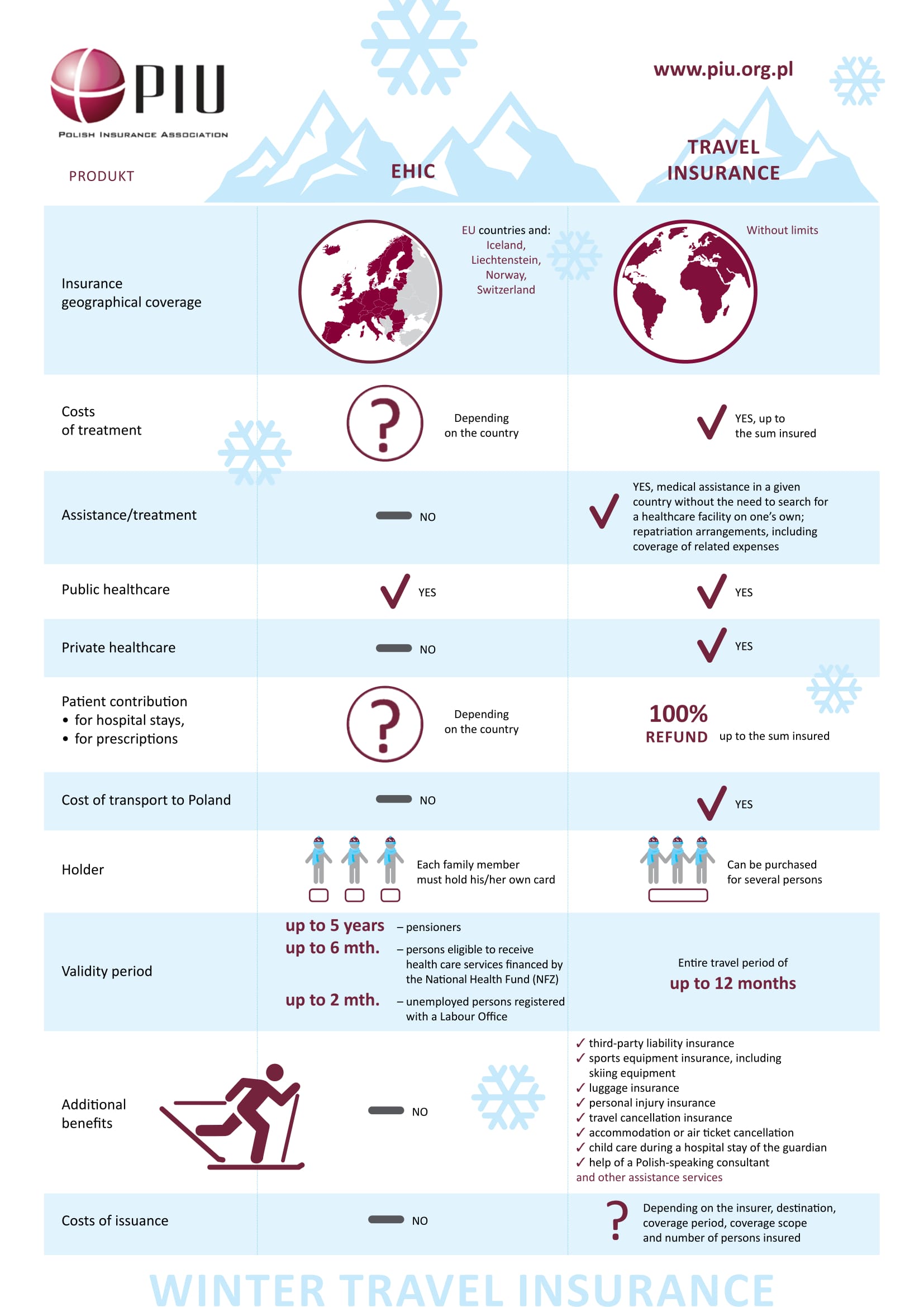

Although very useful, the European Health Insurance Card (EHIC) does not ensure full and free medical care, mountain rescue abroad and medical transport to Poland. Unfortunately, the costs of such interventions may reach several hundred and even tens of thousands euro. Therefore, to protect your home budget, it is worth securing tourist insurance that will cover the potential costs related to an unforeseen event and decrease waiting time for appropriate benefits. In many European countries we must be ready to co-finance medical services. Therefore, it is advisable to find out in advance how medical care in the country we are travelling to is organised. Additional insurance will allow us to fully enjoy the holiday.

The basics: EHIC

Each person travelling abroad should carry an EHIC, confirming eligibility for medical services outside of Poland. More importantly, each member of the family must have their own document and a number of copies thereof, as it is often required to be left at the medical establishment.

In the Czech Republic you have to pay for services1

At our southern neighbours’ an EHIC holder will benefit from free consultation of primary care doctors. Where a visit to a hospital emergency department is involved, the EHIC holder has to pay a one-off fee of 90 crowns. The costs of treatment at an establishment operating outside the public healthcare system are to be fully paid by the patient. Where the patient sought emergency medical assistance at private establishments, he/she may claim partial reimbursement of the costs involved.

Note! An EHIC holder is not eligible for medical treatment provided by the mountain rescue service in connection with a skiing accident. The patient is obliged to cover full costs of such aid on his/her own.

Payable mountain rescue in Slovakia2

In Slovakia primary care and outpatient specialist care services are free of charge. In the case of a visit to the emergency service, a one-off fee of EUR 1.99 is charged; however, it is cancelled when the patient requires hospitalization. Ambulance transport, including air ambulance, is free of charge, but the same benefits provided by the mountain rescue must be fully paid for by the injured.

Payable stay at a hospital in Austria3

In Austria, in the case of hospital treatment not longer than 28 days the patient has to pay from EUR 12 to EUR 20.1 per day. The basic standard hospital stay includes accommodation and medical service. Employees of the hospital may present the patient with the option of hospitalisation with improved care standard, but in such case he/she has to take additional costs into account. Transport to the hospital is free of charge in the event of threat to life or when the doctor considers that the patient’s condition so requires. Important – mountain rescue and air transport are non-reimbursable!

Free hospital treatment in Italy4

In Italy, the costs of primary care medical advice have to be paid for by the patient – up to EUR 36.15 for a visit. Consultant services will be partially financed by the National Health Fund (NFZ). Interestingly, hospital treatment in Italy is free of charge, however the EHIC holder will have to contribute to the transport. It is worth knowing that in many resorts there are only private doctors’ establishments, which do not recognise the EHIC. Moreover, health benefits associated with the consequences of sport accidents may be subject to higher charges than standard healthcare services.

In Switzerland you have to pay for a GP visit5

The EHIC holder has to pay 33 francs in the case of minors and 92 francs for adults for advice of a general practitioner, a consultant, a dentist or stationary hospital treatment. Furthermore, the cost of hospitalisation is 15 francs per day. Children and persons up to 25 years of age who continue to learn are exempt from the fee. Pregnant women using health care services are exempt from these charges. However, every patient using medical road or aircraft transport, including in the event of mountain rescue, is obliged to cover 50% of the costs.

In France the surcharge for a GP visit is 30%6

A patient enjoying healthcare benefits on the basis of the EHIC in France has to first cover the costs by him/herself and may apply for their partial reimbursement. The cost of primary care physician’s and dentist’s consultation amounts to EUR 23, whereas of consultant’s consultation – EUR 25. To recover the costs, a set of relevant documents has to be filed with the French health care fund. In such case 70% of the costs shall be reimbursed upon return to the country. What is important, if the doctor we are visiting is charging a fee higher than the rates set in the health care fund’s price list, the patient has to pay the difference by him/herself. In the case of hospital treatment, the health care fund covers 80% of treatment costs; 100% in some cases only. The patient must cover the remaining 20%, including the daily lump-sum fee. Mountain rescue cost is 100% paid by the injured.

How to select a tourist policy tailored to your needs?

Let us remember to think carefully what protection we need and who should it cover before purchasing policies. One policy may protect one or several persons, for example the entire family. In addition to medical care, a tourist policy usually covers the costs of destroyed or lost luggage, abandonment of accommodation already paid for or damage to electronic or sports equipment. Where we become responsible for an accident, for instance on the ski slope, civil liability insurance covers the costs of victim treatment or repair of his/her equipment.

Usually, tourist insurance enables us to select two options concerning the sports practised: amateur or competitive, and each insurer defines these categories differently. The General Terms and Conditions of Insurance often specify individual disciplines. Before signing an agreement, we have to read the document and decide which option is appropriate for us. If there are any questions as to the scope of protection, we should request the insurer to provide explanations, for instance through the hotline. A tourist policy may be purchased in many ways. Contact with an insurance agent remains the most popular one. Insurance may also be contracted over the internet or via a hotline. The cost of a tourist policy for the entire family for a two-week trip should not exceed several hundred PLN.

[1] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/czechy

[2] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/slowacja

[3] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/austria

[4] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/wlochy

[5] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/szwajcaria

[6] https://www.ekuz.nfz.gov.pl/wypoczynek/wyjezdzam-do/francja

The “In recognition of service to the insurance industry” awards were presented on 17 January 2017 during the Extraordinary General Assembly of the Polish Insurance Association. For many years now, PIU has been awarding people and institutions for their work for the industry’s professional association and contribution to the development of the Polish insurance market. The awards were received by the following persons:

- Andrzej Jarczyk

- Mariusz Kłosowski

- Agata Skrężyna-Dudek

- Hubert Grochowski

- Magdalena Szczepańska

- Iwona Borkowska

- Robert Kowalczyk

- Bartosz Okrasa

- Angelika Pietrzyk-Paczosa

- Grzegorz Kusy

- Waldemar Kozłowski

- Bartosz Dąbrowski

- Elżbieta Rajter-Łożyńska

- Jadwiga Łoś-Ujda

- Ruzica Walkiewicz

- Barbara Wdowiak

- Karol Jasik

- Halina Panek

- Agnieszka Hołubowska

- Jerzy Świątek

The President of the Office of Competition and Consumer Protection signed the agreements with 16 life insurance companies. Due to these agreements, claims adjustment fees collected from customers in cases of unit-linked insurance (uli) will be reduced. –The agreement was initiated by the Polish Insurance Association, but it must be emphasised that it concerns the entire insurance industry. The solution is an effect of the considerable efforts of insurance companies, but it has enabled the satisfaction of meeting customer expectations – says Jan Grzegorz Prądzyński, the President of the Board of PIU.

The agreements concern active insurance contracts, at which insurers were collecting claims adjustment fees higher than those agreed upon with the Office of Competition and Consumer Protection. In regards to inactive contracts, the refund of fees applies to all persons who:

- concluded the contract with the unit-linked insurance with a regular premium after 61 years of age

- and they entered into this contract (or acceded to such a contract) after 1 January 2008

- and terminated this contract or withdrew from it (in the case of group insurance) after reaching 65 years of age

The content of agreements with individual insurance companies is available at the website of the Office of Competition and Consumer Protection.

Information on agreements can also be found on websites of insurers. The agreements concern:

- Aegon TU na Życie S.A.

- TU Allianz Życie Polska S.A.

- Aviva TUnŻ S.A.

- AXA Życie TU S.A.

- Compensa TU na Życie S.A. VIG

- STUnŻ ERGO Hestia S.A.

- Generali Życie TU S.A.

- MetLife TUnŻiR S.A.

- Nationale-Nederlanden TUnŻ S.A.

- Open Life TU na Życie S.A.

- PKO Życie TU S.A.

- PZU Życie S.A.

- TU na Życie Europa S.A.

- TU na Życie Warta S.A.

- UNIQA TU na Życie S.A.

- Vienna Life TU na Życie S.A. VIG

Moreover, the agreement was also concluded between the President of the Office of Competition and Consumer Protection and the Polish Insurance Association.

The Polish Insurance Association has delivered Prime Minister Beata Szydło a letter, in which the PIU emphasizes that the mission of insurers is first of all assistance to the injured and their financial protection.

PIU is at the disposal of the government in all issues regarding the motor vehicle civil liability insurance (OC) for vehicle owners. We declare full readiness for any consultations with the state authorities and we support the idea of working out specific solutions ensuring balance on the market and the security of Polish drivers.

PIU would like to stress that it is necessary and feasible to take up legislative works, which could make the life of drivers much easier. According to the PIU, regulation of the amounts of compensations is a priority. The lack of such regulation simply means that the insurance prices and their future growth patterns are unpredictable.Another issue is prevention and punishing the persons permanently breaking road traffic regulations with high OC rates. A legislative change, giving insurers a wider access to the Central Register of Drivers (CEK), particularly to the information on fines, will implement that the burden of rate growths will primarily affect all road hogs, who commit offences most dangerous for other participants of the road traffic.

Letter to the Prime Minister Beata Szydło

As results of data gathered by the Polish Insurance Association, after the first half of 2016 the premium collected on the health insurance market amounted to PLN 263.5 million. This constitutes almost an 11% increase as compared to the previous year. The highest growth is observed in individual insurances, where the premium increased by as much as 16%.

The number of policyholders increased YoY by 26% and reached the number of PLN 1.67 million. Most frequently held insurances are group policies, usually purchased by employers or employees – almost 1.4 million. However, the highest (44%) increase in the number of customers is visible in individual insurances.

– In Poland, additional health insurance are usually an element of social benefits. Although the number of the insured is increasing, additional health insurance is still not a common trend. If we want this type of insurance to be available to the average Pole (Kowalski), appropriate regulations and systemic changes must be introduced to enable its development – says Dorota M. Fal, adviser to the Management Board of the Polish Insurance Association for health insurance.

| WHOLE MARKET | Gross premium written [PLN] CUMULATIVELY | Number of the insured [persons] CUMULATIVELY |

| individual insurance | group insurance | individual insurance | group insurance |

| 2Q 2015 | 32,114,925 | 205,282,480 | 218,020 | 1,105,397 |

| 2Q 2016 | 37,407,382 | 226,145,586 | 314,210 | 1,359,505 |

Mr. Janusz Popiel, Chairman of the Alter Ego Association, has published an entry on Facebook interpreting the data from the PIU report on motor vehicle insurance. We would like to refer to this entry, because interpretations of the Polish insurance statistics may raise some doubts. The Chairman pointed out in his entry that the statements concerning the growth of paid out compensations “may raise justified doubts”. Therefore, we would like to directly refer to the quotations from Mr. Chairman’s statements illustrating his thesis.

Quotation 1.

“The total number of damages that occurred in class 10 in 2015 was 861 thousand and decreased in comparison to the level from 2014 by 3.5%. However, non-personal damages decreased only by 1.2%, and personal damages by as much as 26.1% within the same period.”

Of course, the number of damages fell down, because for years we have had less accidents and collisions, both with fatalities and non fatalities. When explaining the increase in prices of motor civil liability insurance (OC), PIU always emphasizes that the value of paid out compensations and benefits is constantly increasing despite a fall in the number of accidents and collisions.

Quotation 2:

“In the last three years, the value of an average payment of compensations and benefits in class 10 was systematically decreasing and in 2015 amounted to PLN 4.78 thousand. This is less than the 5 year average, which amounted to PLN 4.9 thousand.”

Yes, because underlying the increase in compensations and benefits is not only the average payment, but also the increase in the number of payments, i.e. individual awards of payments to the injured. It can be found in the report on page 23:

If we have a considerable growth of payments from one claim (e.g. many persons injured in an accident or persons receiving compensations due to one accident), then the average payment may decrease even with a considerable increase in the total amount of paid out compensations and benefits.

Quotation 3:

“Using five-year perspective, the annual average decrease in the gross value of paid out compensations and benefits amounted to 1.7%, but in relation to the record held in 2012, the year 2015 shows that the level of this value has been lowered by as much as 11.1%. The real value of average compensation, with allowances made for inflation, has been annually decreasing by 2.3% on average, i.e. by 8.7% in relation to 2011”

The title of the section, to which Mr. Chairman refers, concerns compensations and benefits in relation to the number of payments in class 10. It is clearly indicated in the report. So, again – the average payment value may fall down when the number of payment grows. In turn, the total burden is increasing, as you can see on page 26 of the report:

Summing up:

- a claim is not the same as a payment. There may be a few payments per one claim. The number of claims may decrease (which is happening), but still the number of payments and, as a consequence, the total number of compensations paid out may increase (which is also happening).

- the amount of one paid out compensation and benefit may increase irrespective of the average single payment. It is enough to imagine one payment at the amount of PLN 10 versus two payments under the same claim at the amount of PLN 10 each. The average is higher in the first case, but the payment is higher in the second case.

We very well understand the wish to deepen the knowledge of the motor vehicle civil liability insurance (OC), especially since there has been much debate around this topic recently. PIU emphasized many times that the main reason behind the currently observed growth of the insurance policy price is the extended coverage of the injured and the increasing value of benefits paid out. We kindly request those persons who have any doubts regarding interpretation of the contents of the PIU publications to contact the PIU office. We are always available to help. All persons interested in the publication are kindly encouraged to read it.

Photos under the link: https://piu.org.pl/wyjasnienia-interpretacyjne-do-raportu-komunikacyjnego-piu/

On Monday, 21 November of this year, J. Grzegorz Prądzyński, the President of the Board of PIU, took part in the debate organised in the editorial office of “Rzeczpospolita” daily. The meeting was dedicated to the activities of compensation claims companies which offer assistance to persons most injured in accidents. Other participants of the debate were: Paweł Sawicki from the Office of the Polish Financial Supervision Authority, Aleksander Daszewski, legal counsellor from the Office of the Financial Ombudsman, Jakub Nawracała, legal counsellor and Bartłomiej Krupa, Vice-President of the Board of Votum.

During the meeting, President Prądzyński pointed out the fact that compensation claims companies should be subject to all relevant regulations as participants of the insurance market. Among the areas to be regulated as listed by President Prądzyński are the issues of remuneration of insurance agents, benefit payment methods and ethics, including the manner of customer acquisition.

The record of the debate is available on the pages of “Rzeczpospolita”:

http://www.rp.pl/Ubezpieczenia/311239856-Rynek-odszkodowan-Wiecej-pieniedzy-dla-ofiar-wypadkow.html

In the period from January to September 2016, Polish insurers paid out PLN 27 billion in compensation and benefits to the injured and other customers. This is 4.4% more than last year.

Key financial data after the first three quarters of 2016:

- PLN 57.6 billion of insurers’ assets are funds supporting the economy and public finances by domestic bonds and other fixed-income securities

- PLN 24.7 billion of insurers’ assets are funds invested on a long-term basis in shares of the companies from the WSE and other fixed-income securities

- Income taxes due and the tax on assets amounted to almost PLN 1 billion

- Insurers collected PLN 40.7 billion in premiums, which is 0.4% less than the year before.

Motor vehicle insurance market:

- The premium for motor civil liability insurance (OC) of vehicle owners amounted to almost PLN 8 billion (an increase of 32 per cent)

- Gross compensation and benefits under motor vehicle civil liability insurance (OC) amounted to PLN 5.7 billion (an increase of 14.8%)

- Gross written premiums on comprehensive Auto Casco (AC) insurance amounted to PLN 4.8 billion (an increase of 18.4%)

- Gross compensation and benefits under comprehensive Auto Casco (AC) insurance amounted to PLN 3.1 billion (an increase of 9.6%)

– motor vehicle civil liability insurance (OC) remains unprofitable, however, a remarkable increase in the premium has been observed on the market. It has been justified from an recently emphasised economic point of view, among others, in the statements of representatives of the Office of Competition and Consumer Protection (UOKiK). It is worthwhile to point out that an increase in the amounts of premiums obliges insurers to establish higher financial provisions, which alleviates to a considerable extent the impact of an increase in premiums based on the current result. Evidently, an increase in premiums should have an impact on the improvement of the result over a long term period, but what we can see in the interim is first activities aimed at ensuring customer safety, which is confirmed by higher provisions – says Jan Grzegorz Prądzyński, President of the Board of PIU.

Non-life insurance market (Section II exclusive of motor vehicle insurance)

- The total premium on non-life insurance (exclusive of motor vehicle insurance) amounted to PLN 10.2 billion and was higher by 1.5% than a year before.

- The following types of insurance have the biggest share in the premium on the non-life market: insurance against fire and other natural forces (PLN 2.2 billion, YoY decrease by 0.7%), insurance against other property damage (PLN 1.8 billion, increased by 6.2%) and motor civil liability insurance (OC) (PLN 1,4 billion, YoY increased by 10.5%).

– In 2016, the key events on the non-life market were huge damages connected with agricultural crops. Payments for damages in the so-called other property class increased YoY by as much as 77%, and their amounts exceeded PLN 1.2 billion. Over half of these funds was paid out by insurers to farmers, which enabled them to compensate for losses in crops caused mainly by unfavourable weather conditions – explains Andrzej Maciążek, Vice-President of the Board of PIU.

Life insurance market

- The value of the premium on a life insurance policy amounted to PLN 17.8 billion (a decrease of 14.5%)

- The value of benefits from life insurance amounted to PLN 13.5 billion (a decrease of 7.2%)

– On the life insurance market we see a continuation of the trend connected with a decrease in the premium from investment-type insurance. The new legal regulations that have been in force since the beginning of this year have had an impact on a decrease in sales of this type of insurance, but at the same time made customers more consciously in selecting service options – says J. Grzegorz Prądzyński.

Financial results of insurers

The net profit of life insurers after the first three quarters of 2016 amounted to PLN 1.7 billion and was by 26.3% higher than a year before. Non-life insurers ended Q3 2016 with a profit of PLN 1.2 billion (a decrease of 37%). The technical result on life insurance amounted to PLN 2.1 billion and was 2.4% higher than a year before. The technical result of non-life insurers amounted to PLN 196 million and was 52% lower than after Q3 2015. The income tax due from Polish insurers after Q3 2016 amounted to about PLN 586 million, and tax on assets amounted to PLN 450 million.

Table of results

The Polish Insurance Association has prepared a document titled “Good practices of the Polish Insurance Association on the Polish insurance market in equipment insurance”. The objective of all good practices is to improve the quality of information provided to all customers who at the time of purchase of electronic equipment, radio and TV equipment/household appliances receive an additional insurance offer.

Such insurance provides for protection in the case of the equipment’s failure or damage. – Due to high interest in these services and the signals we get from customers, it is necessary to determine the principles of offering these types of policies and informing consumers about their nature. Our intention is that every customer buying any equipment should be aware of the insurance coverage and its value. I do not have doubts that a good service offered by the insurer at the purchase of electronic equipment is a big value for a customer – says Jan Grzegorz Prądzyński, President of the Board of PIU.

According to good practices, distributors of equipment are obliged to present the information on insurance in such a fair way preventing from equating the nature of protection with the guarantee provided by the manufacturer of the equipment The information provided to the customer in promotional materials, by phone or at the time of purchase must explicitly indicate the legal form of service, the insurer’s name and point out that the protection is not tantamount to the guarantee or warranty for manufacturing defects within the meaning of the Civil Code. An important information for customers is that the good practices are to be adopted not only by insurers, but also by distributors, namely store chains. – The document prepared by us provides for training sessions to be conducted for employees of store chains; this will ensure that the information on insurance given to customers will be reliable and complete – says Jan Grzegorz Prądzyński.

On 14 November this year, the document was delivered to insurance companies. The industry is planning to implement these good practices at the end of the first quarter of 2017. The document has been submitted to consultations with the Office of Competition and Consumer Protection (UOKiK), the Polish Financial Supervision Authority (KNF) and the Financial Ombudsman. In the correspondence with the Polish Insurance Association, the Ombudsman supported the initiative emphasising that it was an important step towards the improvement of the standards of services to customers benefiting from this type of insurance.

Text of good practices in equipment insurance

Opinion of the Insurance Ombudsman on good practices

We invite you to study the most recent report on the bank assurance market in Poland.

Report