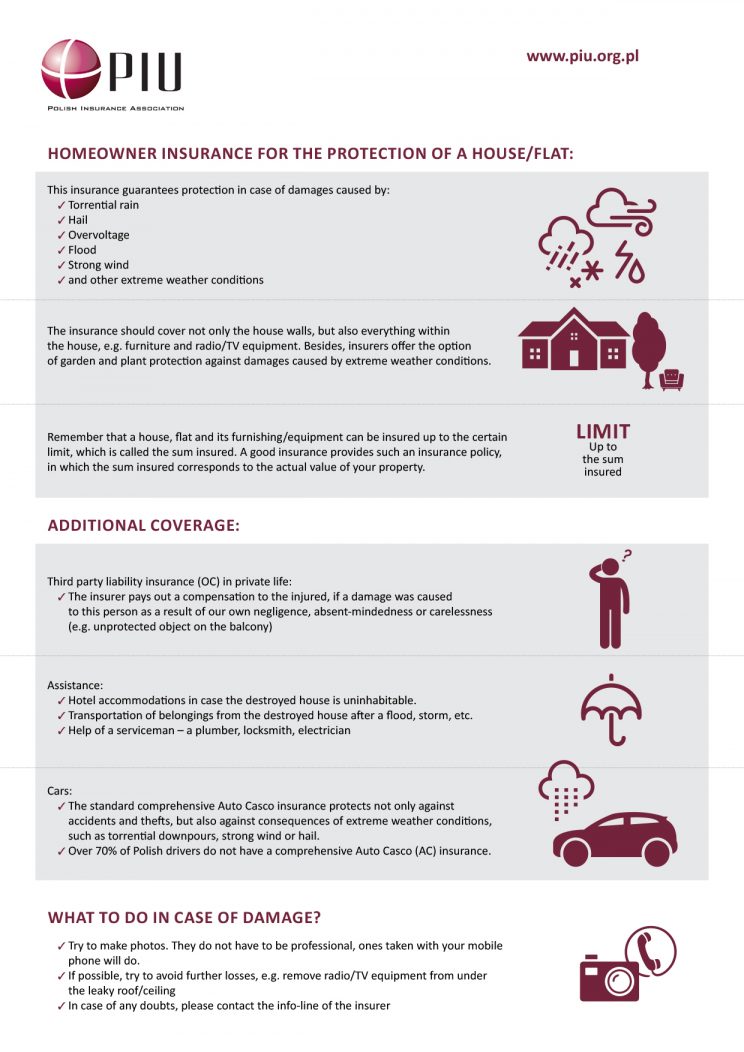

Please have a look at the infographics listed below, presenting the possibilities of insuring the property against extreme weather conditions.

We invite you to study the report “Motor insurance market in Poland, overview of data from 2013-2015”.

We invite you to study the most recent report on the bank assurance market in Poland.

We invite you to study the most recent report on the bank assurance market in Poland.

For a number of years now, PIU has been regularly involved in insurance crime research. The repetitive nature of the research, coordinated by the Committee for Counteracting Insurance Crime and the Subcommittee for Counteracting Life Insurance Crime, carried out with the use of well-established methods, ensures the reliability thereof and makes it possible for the findings to be used to evaluate the systemic solutions intended to counteract the threat of the insurance crime.

Key figures:

- In Section I (life insurance) 836 criminal acts for the amount of PLN 11.3 million were detected. The number of act increased YoY by 57%, and the value of acts by 10%.

- The average value of extortion in life insurance is PLN 13 thousand.

- In Section II (property insurance) 13,129 criminal acts for the amount of PLN 179.8 million were detected. The number of acts increased by 43%, and the amount increased by 19%.

- The average value of extortion in property insurance is PLN 13.7 thousand.

- The number of offences (damages to property) in the area of motor civil liability insurance (OC) is 5,450 acts is in the amount of PLN 54 million

- The number of offences (personal damages) in the area of motor civil liability insurance (OC) is 3,599 acts is in the amount of PLN 58.3 million

- The number of offences in the area of comprehensive Auto Casco (AC) insurance is 2,151 acts in the amount of PLN 33.8 million

- 85% of the events on the property market concern motor vehicle insurance

In the first half of 2016, Polish insurers paid life insurance benefits worth PLN 9.2 billion and non-life insurance compensations and benefits worth PLN 9 billion to clients and the injured.

Key data after the first half of 2016

- PLN 18.2 billion paid to customers and the injured

- PLN 51.7 billion in assets in domestic bonds and other fixed-income securities supporting the economy and public finances

- PLN 22.7 billion of assets supporting the economy, invested on a long-term basis in shares of the companies from the WSE and other fixed-income securities

- PLN 27.2 billion of collected premiums

- About PLN 269 million of paid taxes on assets

Motor insurance market

Key figures:

- The gross written premium on motor civil liability insurance (OC) amounted to PLN 5 billion (an increase of 25.7%)

- The gross compensations and benefits under motor civil liability insurance (OC) amounted to PLN 3.9 billion (an increase of 16.8%)

- The gross written premium on comprehensive Auto Casco (AC) insurance amounted to PLN 3.2 billion (an increase of 17.2%)

- The gross compensations and benefits under comprehensive Auto Casco (AC) insurance amounted to PLN 2.1 billion (an increase of 10.9%)

- The technical loss on civil liability insurance (OC) amounted to PLN 606,5 million.

- The technical loss on comprehensive Auto Casco (AC) insurance amounted to PLN 9 million

– For the first time in many years, we can see a strong increase in motor civil liability insurance premiums (OC) market, which entails a big change in the balance of provisions for premiums. We can still observe a considerable increase in payment, which is a proof that the level of insurance coverage for those injured in accidents has considerably increased. From the balance-sheet perspective, both a change in the balance of provisions and the compensations paid contribute to a decrease in the technical result. In turn, an increase in premiums indicates that insurers are consistently striving to restore the balance in the market of motor civil liability insurance (OC) – says Andrzej Maciążek, Vice-President of the Board of PIU.

Non-life market (Section II exclusive of motor insurance).

Key figures:

- The total premiums for non-life insurance (exclusive of motor vehicles) amounted to PLN 7.1 billion, which was 2.7% higher than the year before.

- The following types of insurance have been instrumental for the non-life premium market: insurance against fire and other natural forces (PLN 1.6 billion, YoY decrease by 0.7%), insurance against other property damage (PLN 1.2 billion, increase by 5%) and motor civil liability insurance (OC) (PLN 1 billion, YoY decrease by 7.8%).

– Non-life insurance shows a remarkable increase in payments of compensations in class 9, i.e. other property damage. The total compensations in this class amounted to over PLN 884 million, i.e. by 152% more than the year before. A jump in the value of compensations paid was caused by huge damages in agricultural crops in Q1 and Q2 of this year, mainly due to frosts – explains Andrzej Maciążek.

Life insurance market:

Key figures:

- The value of the premium on life insurance amounted to PLN 11.9 billion (a decrease of 17.4%)

- The value of benefits from life insurance amounted to PLN 9.2 billion (a decrease of 10.6%)

– After Q2 2016, the effect of regulatory changes in the life insurance market is even more clearly visible. The new Act on insurance and reinsurance activity has evidently caused an increase in the volume of information provided to a customer before taking a decision on concluding an insurance contract with an investment element. Such changes resulted in a decrease in sales of such products, but primarily, they encourage customers to select a service more consciously and limit the risk of not tailoring the product to the customer’s needs. It is worthwhile to remember the continuous discussions on the shape of the pension system in Poland. Voluntary, systematic saving will become more and more important. The life insurance market has been created for the purpose of ensuring long-term financial security and it will remain a key segment of a retirement plan – says J. Grzegorz Prądzyński, the President of the Board of PIU

Financial results of insurers

The net profit of life insurers after the first half of 2016 amounted to PLN 1.1 billion and was 33.4% lower than the year before. Non-life insurers ended Q2 2016 with the profit of PLN 1.1 billion (a decrease of 36.9%). The technical result on life insurance amounted to PLN 1.4 billion and was 4.4% higher than a year before. The technical result of non-life insurers amounted to PLN 114 million and was 77% lower than after Q2 2015. The income tax due from Polish insurers after Q2 2016 amounted to approx. PLN 382.9 million. In the first half of 2016, Polish insurers also paid about PLN 269 million in tax on assets.

The Polish Insurance Association was a main partner of this year’s Moto Safety Day. It is already the 11th edition of this event, which concerns safety in road traffic and improved automotive culture. This time it took place on the Autodrom Pomorze in Pszczółki between 11:00 and 21:00 hrs.

During Moto Safety Day, participants had the occasion to consolidate positive behaviours on the road through an educational aspect of the event. Participants will have the opportunity to use dedicated educational zones promoting safety in road traffic from an early age. Participants had at their disposal, among others, the experts

from the Pomeranian Centre of Road Traffic, the representatives of the Police Department of Prevention and Road Traffic KWP in Gdańsk and the Partners, for whom safety in road traffic is extremely important. The event was hosted by an automotive journalist – Kuba Bielak.

We invite you to watch the film report of the event.

July is the month when the birth rate in Poland is the highest. In July 2015, over 34 thousand children were born. As a comparison, in February slightly over 27 thousand were born. The time of waiting for the most precious treasure is connected with many doctor’s appointments and thinking about the future of a newborn baby. Future parents will find such insurance solutions helpful, allowing them to go through pregnancy and delivery without additional stress and will ensure their kids a head start into adult life.

Insurance for mothers

It is worthwhile to think first of all about a policy, which will ensure appropriate medical care during the time of pregnancy. Most insurance companies use grace periods that may last up to 12 months. It is worthwhile to note that the offer of insurers is much more attractive than the care reimbursed by the National Health Fund (NFZ).

The scope of insurance covers benefits connected with monitoring of pregnancy – unlimited visits to a gynaecologist and diagnostic tests. One should remember that basic policies include only outpatient care. If we want our insurance to cover hospitalisation, we must choose an extended coverage option. Before taking out an insurance policy we should also check whether the physician whom we want to monitor our pregnancy has a medical practice in the facility with which the insurer cooperates. Some insurance companies allow for the possibility of visits to the doctor from outside such a pool, but it may entail additional costs, which are described in the general terms and conditions of insurance (OWU). Insurers also offer “premium” packages. Holders of such a policy may expect comfortable delivery conditions in the advanced standard or post-delivery medical care – says Dorota M. Fal, adviser to the Management Board of the Polish Insurance Association for health insurance. It is also worthwhile to consider policies which, after the child’s birth, extend the coverage scope by medical care of a child.

Dowry insurance

The aim of most parents is to ensure their children a stable and peaceful future. That’s why insurers proposed such products as a dowry policy, otherwise known as child’s maintenance insurance. This insurance is a saving and protection scheme, which is targeted not only to parents, but also to grandparents, godparents and any other persons, who want to ensure a child’s financial security. One must remember that the contract shall be concluded before the child reaches 18 and shall cover the period from 5 to a maximum of 25 years. Policies may be of a protective nature, when the sum insured is fixed and set in advance or of a protective and saving nature. In this case, part of the accumulated funds is deposited in investment funds. It is the option that gives a chance for the generation of a higher sum to be paid out. The earlier we invest in a dowry policy, the higher amount our child will get at the time of termination of the contract. Regular payments are a precondition. The capital saved will make it easier for our child to enter into adult life. For what purposes may the funds be used by our child? The purpose may be any – studies abroad, flat, opening their own business, etc. The policy also provides for additional protection against unexpected and tragic events. The dowry insurance ensures a compensation and payment of the collected funds in the case of a parent’s death or guarantees that the insurer takes over the obligation to pay premiums. The unquestionable advantage of this type of insurance is a free choice of the amount of premium and form of payment (one-time or as a monthly annuity).

The Polish Insurance Association, as the only institution, presents the Polish translation of the report “Euro Health Consumer Index – EHCI 2015”, prepared by the Health Consumer Powerhouse. The English version of the report was published in January 2016. The Euro Health Consumer Index has been published since 2005. The Swedish ranking service monitors health care services in 35 countries against 48 parameters, including but not limited to: observance of the patient’s rights and access to information, treatment results, range of services, prevention and consumption of drugs. It is prepared on the basis of publicly available statistical data, questionnaires filled in by patients and independent surveys conducted by Health Consumer Powerhouse Ltd., a private company with registered offices in Sweden, which evaluates the health care standards in Europe and Canada, thereby strengthening the position of patients and beneficiaries. In the annual ranking of EHCI, Poland was awarded 523 points out of a possible 1,000 and was ranked at the 34th, which was second-to-last place. By comparison, the Netherlands won with 916 points. The last place was taken by Montenegro; we were outrun by Albania, Romania, Bulgaria, Serbia, Czech Republic and Slovakia.

The author of Euro Health Consumer Index report is Health Consumer Powerhouse. The opinions expressed in the report are those of the author.

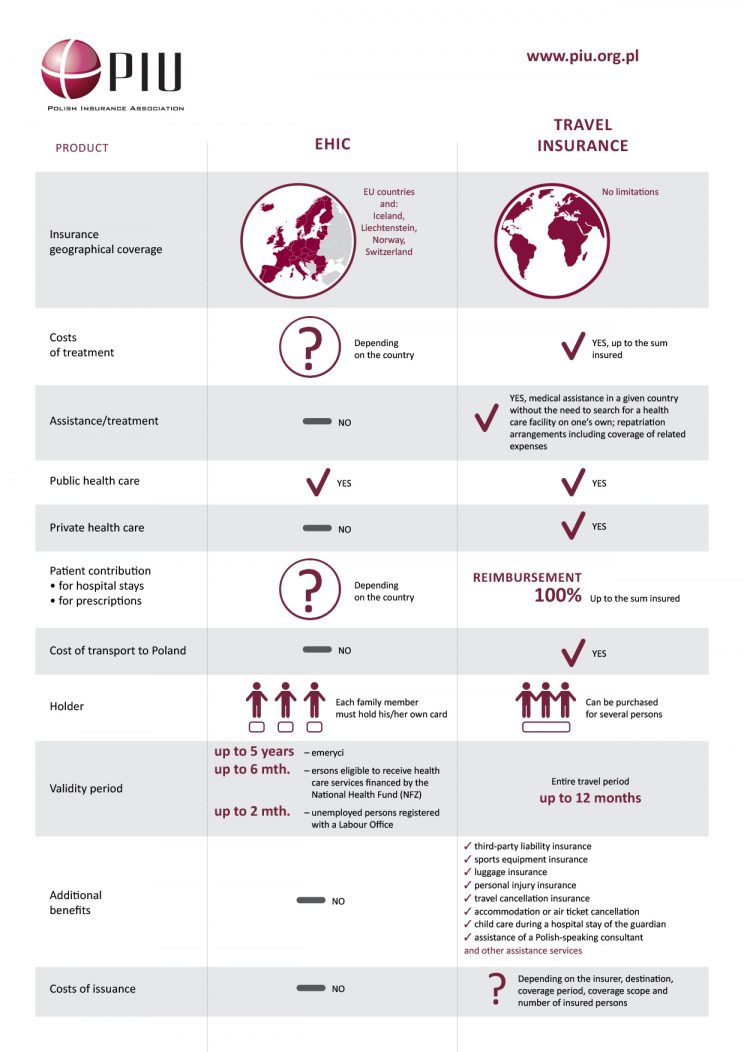

We invite you to have a look at the infographic material below, presenting differences between travel insurance and the European Health Insurance Card (EHIC) issued by the National Health Fund (NFZ). This is the knowledge worth acquiring while planning a holiday trip.